A new volatile, uncertain, complex and ambiguous world of banking is emerging

UPDATE – Sun 3/26/23 12:42 AM

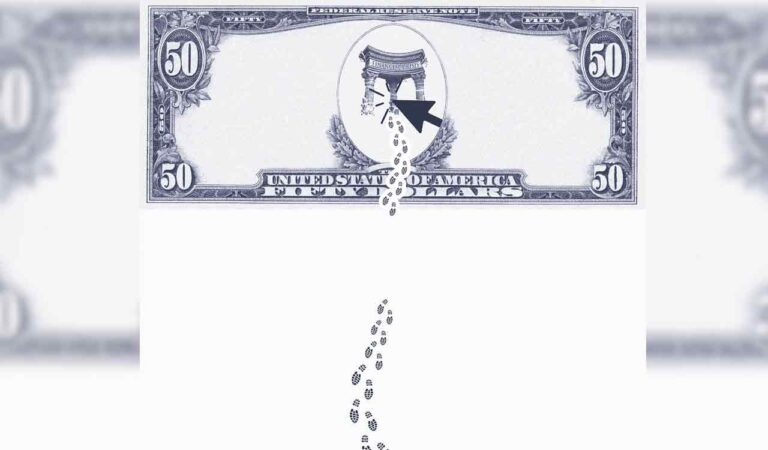

Illustration: Guru G.

By S Ganesh Kumar

Hyderabad: Much has been said about the collapse of Silicon Valley Bank (SVB) on March 10, 2023. The matter will be dissected in detail, with analysts and pundits providing input, which may shed light on the future regulatory framework, enabling better risk management. Today’s economic world will continue to thrive.

economic progress

There is no doubt that banks play a decisively positive role in any economy. Although there may be slight differences between different countries, it must be recognized that in today’s world of Gothenburg, economic activity is largely dependent on banks; in addition to the critical function of accepting deposits for lending, banks also perform countless other critical functions — — Monetary transmission, trade facilitation, liquidity provision, credit extension, and other key components of economic activity. Therefore, a healthy and sound banking system is an important component of good economic activity and the healthy development of a country.

trusts and banks

Trust is the foundation of banking. The interests of depositors thus become an important requirement for bank security. In India, trust of depositors in banks is high compared to many other countries. Decades of hard work by RBI has given ordinary people confidence in banks. Therefore, failures like SVB’s are outside the perception of the general banking public.

Perhaps the greatest turmoil that negatively affected the banking sector as a whole was during the global financial crisis of 2007-09. Then came the pandemic, which affected almost every economy in the world. With the worst of the pandemic behind us and a widespread recession in many parts of the world, the collapse of a major U.S. bank has caused waves.

Regulators and the government in the U.S. realized that depositors’ trust in the banking system was declining rapidly, so they stepped in to appease depositors. Result: SVB’s deposit is guaranteed on March 12, 2023. While this may have a reassuring effect on the banking public, much remains to be done to restore public confidence in the banks.

Banking and Regulatory Action

Regulatory action can be ex post, that is, after certain events, and supervisory action focused on mitigating the impact of such events will attempt to restore depositor confidence. However, coercive measures related to macroeconomic policies can also have a disincentive effect. The latest hike, in which the Fed raised its short-term funds rate by 25 basis points — the eighth consecutive time in a range of 4.75% to 5% — was aimed at keeping inflation in check.

While necessary, this will have repercussions after the bank fails. Coupled with the fact that other central banks around the world are also tightening their macroeconomic policy stance, largely around tackling inflation, the pressure on them to bolster depositors’ confidence in their banks will only increase.

An economic slowdown in much of the world and a tightening of start-up activity are factors challenging the banking sector

envirnmental factor

The world economy is at a crossroads. There are positive indicators and there are challenges that need to be addressed. Environmental shocks in the form of global unrest and war must be dealt with; the growth of new sectors around technology and the prominent role of start-ups are positive factors for banks. However, it has not been all plain sailing for the sector – problems facing start-ups (which is particularly relevant to SVB given its customer base), a slowing economy and a tightening of start-up activity in much of the world are all factors that are challenging the banking sector, The banking industry has witnessed a boost from these sectors.

Fintech has sprung up like mushrooms

The growth of fintech companies, especially in India, in offering newer types of products and services has been phenomenal. While customers are the ultimate beneficiaries of these initiatives by fintech companies, the banking system has also greatly benefited from them. The banker has not only become the largest user of new services provided by fintech companies, but also supports fintech companies in their growth journey. Extending credit to these entities, utilizing their services, and even becoming a partner in some new initiatives of fintech companies are all positive indicators of growth in the sector, which in turn has a positive impact on the economic growth of the country.

Given the high reliance of fintech companies on failing banks, the failure of a bank like SVB – albeit in a different part of the world – is bound to have a knock-on effect on the fintech industry. While the full impact will be witnessed in the coming days, it may be a safe assumption considering that the Indian economy is expected to grow at a higher level and most of the fintech companies’ operations and fund-related activities are concentrated within India. Apart from the impact on potential new business volumes, there will be no large-scale adverse impact on the Indian fintech industry in the near future.

The possibility of long-term effects cannot be ruled out, as the fintech industry operates in an interconnected world and events in one place have the potential to affect the entire industry. Regulatory requirements for banks will be tougher, which doesn’t necessarily mean there is an opportunity for fintech companies (in the form of their services to reduce bank risk), but there will also be challenges as the industry relies heavily on banks.

Since the fintech industry operates in an interconnected world, the possibility of long-term effects cannot be ruled out.

Given that fintechs – especially start-ups – already face challenges with the availability of funds to meet their needs, increased controls will make it harder for fintechs to secure funding; levels of confidence for successful fintechs to deposit all surplus in banks May also be hit.

prediction failure

Regulators and governments will be under pressure to beef up their surveillance systems to prevent a repeat of the types of bank failures seen so far, while providing early warning signals that could lead to proactive measures or swift action anytime, anywhere. where needed. Some measures that may be taken in this regard may include:

• Added reporting requirements: This may be seen by FinTechs, especially those focused on RegTech (Regulatory Technology) and SupTech (Regulatory Technology), as an opportunity to fill a gap in the current system.

• More real-time monitoring systems: This will require the development of more efficient systems with higher interdependencies. While tools such as artificial intelligence and big data analytics help, issues such as data privacy, the potential for data misuse and incorrect interpretation of analytics are some of the factors that banks and regulators, as well as fintech and other industries, may have to effectively address in service provision business.

• Increased control: Increasing control systems within banks and regulators will be an activity to be dealt with. Existing control systems will be transformed into more stringent systems with enhanced feedback mechanisms. This could be an opportunity for the business prospects of fintech companies, while requiring them to meet the increasing requirements everywhere their products and services are used.

• Stricter supervision: There will be stricter oversight of tasks undertaken by banks and those that are outsourced or performed in partnership with other entities. This may require a review of existing frameworks between banks and other entities.

• Cooperative effort: Combined with the above, there will also be an increasing need for increased cooperation. The future will increasingly see models based on cooperation and joint operations; this must be juxtaposed with regulatory requirements for separation of business functions and responsibilities, with a clear separation not only of the roles of the individual entities, but also of each participant in the group finances.

• Risk-Based Regulation: Bank supervision has been strengthened, and risk supervision has been further strengthened. New matrices will be developed outlining banks’ risk levels and likelihood of failure, which will then be followed by further scrutiny and stricter action if required by regulators.

• Less tolerant to bias: We will see more regulatory action and less tolerance for deviation; these will require banks to assess risk more comprehensively and manage it better.

• “No failure” expectation: Perhaps the most important change is that customers’ expectations of “no trouble” will also increase, which will increase the need to adopt more communication – in terms of content, channel and frequency.

The world of the future will be one in which banks will play a greater role. They must be agile, adaptable to change and more open, but at the same time must be well managed, look inward when needed, make more data-based decision-making, collaborate and coordinate with other entities, and grow for mutual benefit, across the board.

Let’s face the new turbulent, uncertain, complex and ambiguous world of banking ahead…

(The author is a former executive director of the Reserve Bank of India)

Bank Dash!

• Silicon Valley Bank (SVB) was one of the first banks to fail, serving IT companies, especially venture capital technology companies

• A bank failure like SVB – albeit in a different part of the world – is bound to have a knock-on effect on the fintech industry

• On March 8, the $200 billion bank announced plans to raise fresh capital; by the morning of March 10, it was insolvent and under government control

• The FDIC estimates customers withdrew $40 billion in just a few hours — a fifth of SVB’s deposits. On March 12, the FDIC closed SVB before closing hours

• The second largest bank failure in U.S. history, after Washington Mutual’s failure in 2008

• Reportedly the first bank run of the digital age.Depositors withdraw money in minutes using app and phone

• On March 13, New York-based Signature Bank was seized by regulators in the third-largest US failure

• On March 19, Swiss authorities pushed UBS to take over Credit Suisse after its shares plummeted and depositors fled, sparking fears of its possible collapse.Credit Suisse is one of 30 banks with global reach

• Shares of Germany-based Deutsche Bank fell sharply on March 24, turning the spotlight on another bank