India’s population recently surpassed that of China. Can it repeat the export feat?

Posted Date – Sunday, 4/23/23 at 12:30pm

by AnithaRangan

Hyderabad: China has been known to replace the United States as a world trading partner in the past decade, while India has only barely followed suit. While India and China are compared on several fronts, exports are one area where India may not impress. Nonetheless, it is worth noting that India has made strides in both trade escalation and diversification of export partners.

The future is indeed bright and it is possible to close the gap with the world and China. The gap may still exist, but it will certainly narrow. how? The growing focus on shifting global supply chains from China outside of Europe due to geopolitics presents an opportunity for India. This will be one of the key factors driving the transformation of India’s export structure. Support for rupee-denominated trade and policy initiatives to boost exports would add to the safety net against India’s possible commodity-led trade deficit in the future.

Sticky post

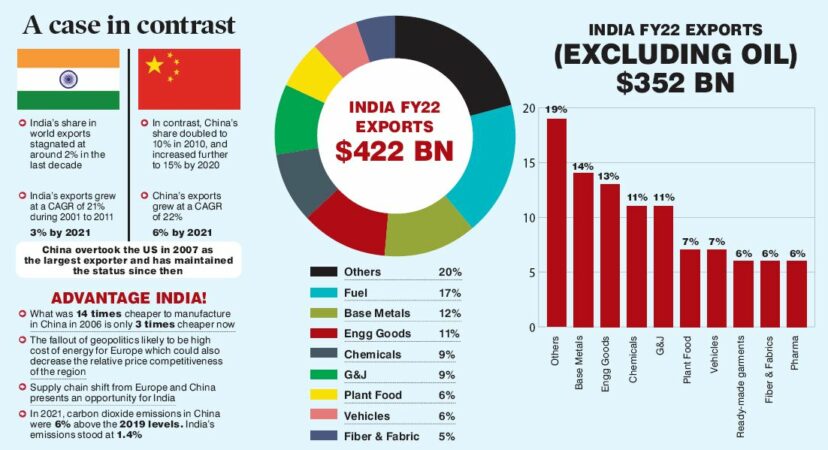

World trade in the first decade of the millennium grew at a compound annual growth rate (CAGR) of 11 percent (2001-2011)—from $6.2 trillion to $18.3 trillion. However, it slowed to a compound annual growth rate of around 2% over the next decade, reaching $22.3 trillion in 2021, as falling commodity prices and relatively benign inflation fueled the trend. India, on the other hand, grew by 21% and 3% over the same period, and China by 22% and 6%, respectively.

China’s exports surged from US$250 billion in 2000 to US$1.6 trillion in 2010 and further increased to US$3.3 trillion in 2021. That brings its share of world trade to 15% in 2021, more than tripling in two decades from 4% in 2001. This compares with the EU’s total share of 18%. China overtook the US as the largest exporter in 2007 and has maintained that position since then.

India’s trade basket has changed over the past two decades. While the early millennium was dominated by textiles and gems and jewelry, the mix has shifted to fuels, base metals, engineered products, pharmaceuticals, vehicles and chemicals. Likewise, in imports, excluding petroleum (one-third share), engineered products are becoming increasingly important. Chemicals, metals and plastics also rose modestly.

However, India’s share of world exports has stagnated at around 2% for the past decade. While it has grown from 0.6% to 1.6% over the past decade, the decade to 2020 is a consolidation phase. In contrast, after doubling to 10% in 2010, China has taken a further 15% share by 2020, becoming the dominant player on the global stage, from developed countries such as the United States, Europe, Japan, the United Kingdom, and Canada seized market share.

Can India copy China? While it will not be easy to replicate China’s size and scale model, there is still potential to close the gap.

Gaps in Armor

Opportunities offered by geopolitical and/or environmental compliance, and a reduction in labor arbitrage in China, offer some low-hanging fruit in favor of supply chain shifts away from Europe and China. China and the EU account for one-third of global trade.

China, traditionally viewed as a low-cost manufacturing base, is under pressure as it loses its cost advantage. Over the past two decades, China’s average wage growth rate has been about 14%, while the average inflation rate has been about 3%. Sustained double-digit wage growth (doubling every 6-8 years) may sustain the labor arbitrage export model from a low base, but the momentum is unlikely to continue. In contrast, weekly wages in the United States have risen by 3% over the past decade. What was 14 times cheaper to manufacture in 2006 is now only 3 times cheaper. On a relative scale, it’s called a “stable holding” as rapid productivity growth and currency depreciation help keep costs in check. (BCG: How Global Manufacturing Cost Competitiveness Has Changed Over the Past Decade).

Stricter environmental compliance by Chinese producers has had a restrictive impact on export-oriented industries such as steel, chemicals and related (plastics). In 2021, China’s CO2 emissions will be 6% (nearly 500 tonnes) above 2019 levels. On the other hand, India’s emissions were 1.4% (30 tonnes) above 2019 levels, making it more likely that India will keep companies in compliance with its environmental, safety and health standards. (Bain & Company, 2022)

The EU and Europe together account for 30-35% of world exports. The geopolitical consequence could be high energy costs in Europe, which could also reduce the region’s relative price competitiveness. The dominance of China, which accounts for 15% of world exports, will also be tested, as the pandemic and its long-term impact on China and the resulting geopolitics have sounded the alarm that the world is diversifying away from China. While the shift of supply chains away from Europe and China presents India with an opportunity to become a key donor, what are the enablers that can help make this happen?

Government policy support is the first driving force

- Production-linked incentive schemes in more than 13 industries, including electronics, automotive, pharmaceuticals, food processing, specialty steel and textiles (man-made fibres), could provide a medium-term boost. Three more industries were added, namely toys, bicycles and drones. In addition, several other initiatives aimed at creating ecosystems for import substitution and export promotion also have a positive impact on medium-term progress. Export-focused initiatives such as One Region One Product, which uses the Export Readiness Index to monitor national competitiveness, are other focused measures aimed at increasing exports.

- India has signed 12 FTAs/RTAs (Free/Regional Trade Agreements) with countries and recently signed one with Australia. Other countries and regions include Japan, South Korea, Mauritius, ASEAN and SAARC. India has also concluded a comprehensive partnership agreement with the UAE. Notably, merchandise exports to India’s trade agreement countries rose by 21% in the five years to FY2021 (Export Readiness Index Documentation).

- Strengthening infrastructure through programs such as the National Logistics Policy (NPL) can provide much-needed impetus to make Indian exports globally competitive by reducing logistics costs and improving the efficiency of export processes. Aspects of NLP, such as the Unified Logistics Interface Platform (ULIP), which aims to integrate all digital services related to the transport sector into one portal, should make exports more competitive.

Of course, don’t overlook the fundamental strength of our diversified export basket. Weaker global growth likely held back growth this year. The near-term outlook, while clouded by a slowing global economy, also suggests that not all sectors are equally sluggish. The bright spot came from industrial machinery and electronics, which collectively rose 25% (April-January 2023), led by around 80% growth in smartphone exports, while other categories also rose 10-25%. Prices of plant-based and prepared foods also rose 10% to 25%. Automobiles and auto parts also show promise led by structural shifts. There are also prospects for a rebound in iron ore and grain exports in the near term. While the discretionary basket may take time to rebound, the non-discretionary basket will support the downturn.

- Settlement in Indian rupees is another driver, especially for emerging market and developing economies. Among other things, it reduces the reliance of the current account deficit (CAD) on external capital financing, the success of which again depends on export growth. The rupee trade settlement mechanism established by the RBI in July 2022 has the potential to boost Indian exports by increasing global interest in the rupee through the use of special vostro accounts (accounts held by domestic banks for foreign banks). the former’s national currency). So far, the Reserve Bank of India (RBI) has approved foreign banks to open vostro accounts in 18 countries. This includes Germany, Russia, Guyana, Israel, Kenya, Malaysia, Mauritius, Myanmar, New Zealand, Singapore and the United Kingdom. Geopolitical conflict initially opened the space to explore this route with Russia. The main deterrent is that a country like Russia with a large trade deficit with us would find it complicated to deploy the INR. However, regulators in India are actively looking for the best solution. The internationalization of the rupee could be a game-changer, especially for developing economies. European Central Bank President Christine Lagarde recently commented that “Euro-dollar status should not be taken for granted.” She mentioned the establishment of an alternative payment mechanism for the Indian rupee (along with the Chinese yuan) as a spotlight moment for India and the world is watching India and its policies.

A rebound in exports is critical to our imports, which are sensitive to commodity shocks. The trade deficit is back in the spotlight, with the deficit in Q2FY23 reminiscent of the one in 2013. While the reserves this time around offset the currency shock, the size of the drawdown is also a reminder that the Indian loonie is funded by “borrowed reserves”. While a recent narrowing of the trade deficit, supported by a strong services sector, has temporarily curbed the trend, the safety buffer has weakened.

All in all, global trade is likely to find new pastures as countries become increasingly interested in shifting supply chains away from China and Europe. This makes India a bright spot at a time when domestic growth is also relatively resilient and the government’s willingness to position India as a beneficiary is very high. Climate and environmental cost considerations also make India a serious competitor. Moreover, capitalizing on these opportunities, many domestic and structural developments such as the PLI scheme and government initiatives to strengthen India’s infrastructure and logistics competitiveness are giving Indian exports the edge they need in global trade. India’s export prospects are bright!

(The author is an economist at Equirus Securities (P) Limited)