In the third quarter of 2022, the overall greenfield construction cost will increase by 5% to 7% year-on-year.

Posted Date – Friday, 11/25/22 at 11:44pm

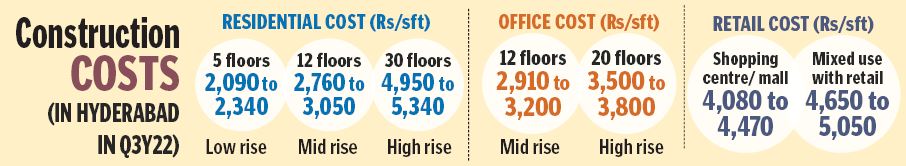

Hyderabad: In 2022, material costs rise due to reduced production during the pandemic and supply chain bottlenecks that increase global transportation costs. In the third quarter of 2022, the overall greenfield construction cost will increase by 5% to 7% year-on-year.

Leading real estate consultancy CBRE South Asia has released the findings of its report “Project Management 2.0 – Driving Value in the ‘New Normal’ Era”, which examines the current market landscape and explores the factors affecting cost trends in key asset classes. factor.

During the quarter, labor costs rose 8% to 10%, and rebar prices rose about 20%, a trend CBRE believes will continue until the end of 2022. Looking ahead, however, inflationary pressures are widely expected to ease in 2023.

This, together with the resolution of supply chain disruptions and more aggressive government policy intervention, may limit material price increases. The report also highlighted that cost pressures are likely to persist in the near term, although overall cost growth is expected to subside in the coming quarters.

Amid ongoing geopolitical complications, material prices are expected to slow in 2023, with expected longer than usual lead times for material deliveries and short-term labor shortages.

The outlook for construction costs remains stable but cautious, as market volatility is likely to persist in 2023 with monetary tightening, persistently high inflation, a possible recession in advanced economies and challenges related to geopolitical instability ahead. As a result, CBRE forecasts a slight rise in overall construction costs across cities in 2023, with Mumbai likely to see a larger rise.

However, strong demand from the construction sector is likely to continue to push construction employment higher. Currently, the availability of skilled construction workers remains a challenge despite employers offering higher wages, benefits, and incentives.

Fuel price volatility could also affect overall input costs in 2023. The report also suggests that the overall impact of costs related to sanitation measures such as disinfection, regular inspections, labor maintenance and additional insurance requirements will subside by 2023.

Rising rents and demand in the market this year have boosted the demand side despite supply constraints, said Anshuman Magazine, chairman and chief executive officer of CBRE India, Southeast Asia, Middle East and Africa. “Construction demand is likely to remain strong in the short term. We expect a relatively stable outlook for India’s economy, with the possibility of a slowdown, however, the high volume of pent-up demand for new construction, including government infrastructure projects, should be largely sustain construction activity in India.”

Gurjot Bhatia, Managing Director, Project Management, India, South East Asia, Middle East and Africa, said: “Despite the headwinds, construction demand is expected to remain strong in the near term. The substantial pent-up demand for new construction should largely sustain the cost of construction marginal growth.”