While the Center has been claiming that the main reason for the rise in the share of duties and surcharges in the GTR is the imposition of GST compensation levies, the states have been urging the Center to include them in a divisible pool and share them with the states.

UPDATE – 10:59 PM, Monday – December 19 22

representative image

Hyderabad: Under the Modi regime, the share of duties and surcharges in the federal government’s gross tax revenue (GTR) soared from 8.16 percent in 2011-12 to 28.08 percent in 2021-22. While the Center has been claiming that the main reason for the rise in the share of duties and surcharges in the GTR is the imposition of GST compensation levies, the states have been urging the Center to include them in a divisible pool and share them with the states.

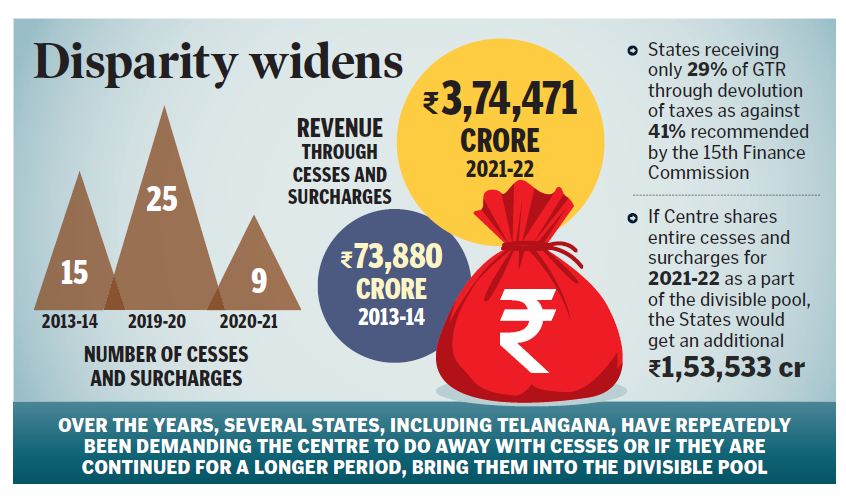

During the UPA regime, 15 duties and surcharges were imposed by the central government from 2010-11 to 2013-14. The number of taxes and surcharges was increased to 25 by 2019-20 after the BJP-led NDA came to power at the centre. However, many of these were included after the introduction of GST and currently, nine taxes and surcharges are being levied by the Centre. These nine taxes and surcharges have brought in revenue of Rs 3,744,710 crore in 2021-22, a five-fold increase as compared to Rs 7,388 crore in 2013-14.

According to the Center’s own admission in Parliament, taxes and surcharges account for 28.08% of the Centre’s GTR. However, the states’ share of the GTR for 2020-21 is around 29 per cent due to increased taxes and surcharges, according to the PRS Legislative Research study. This is lower than the central tax share of 41% recommended by the 15th Finance Committee.

The surge in revenue from taxes and surcharges was mainly attributable to an increase in the effective rate of road and infrastructure taxes due to the imposition of additional excise duties on motor petrol and high-speed diesel. However, Pankaj Chaudhary, Minister of State at the Union Finance Ministry, claimed that the surge in duties and surcharges was mainly due to the imposition of the GST Compensation Tax, which was fully used to pay compensation to the states and flowed to the states as aid grants, in their Receipt in budget. He said resources from other taxes were allocated to different programs and programs in the Union Budget to be implemented by the states and other executive agencies.

Over the years, several states, including Telangana, have repeatedly asked the center to either abolish the land tax or include it in a divisible pool if it continues for a longer period. It may be noted that despite the increase in duties and surcharges, the proceeds do not flow to the states as they are not included in the divisible pool.

Due to the Centre’s reluctance to include duties and surcharges in divisible pools, states received only 29 percent of GTR through tax devolution, compared to the 41 percent share proposed by the 15th Finance Council. States will get an additional Rs 1,535.33 crore if the Center apportions all taxes and surcharges for 2021-22 as part of a divisible pool, as recommended by the Finance Committee.