Given the trade-off between growth and inflation, Governor Das made the right call, especially against the backdrop of a slowing global economy

Posted on – Thursday 13 April 23 at 12:30pm

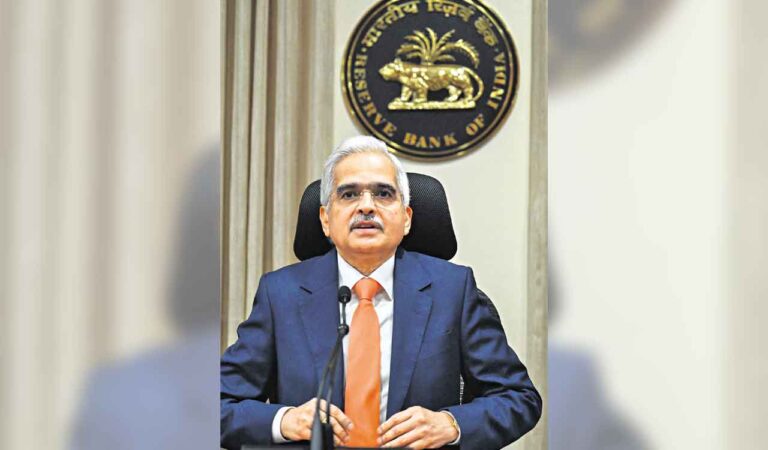

file photo.

By Dr. Manoranjan Sharma

Hyderabad: The Reserve Bank of India (RBI) is widely expected to raise its benchmark interest rate by 25 basis points to a seven-year high of 6.75% at its seventh consecutive meeting on April 6, with further hikes clearly likely to keep inflation within its comfort zone Inside. Since April 2022, almost all central banks have raised interest rates, and the cumulative number of rate hikes is 450 bps in the US, 450 bps in Hong Kong, 400 bps in Canada, 350 bps in the UK and 350 bps in Australia.

The streak of rate hikes began with a 40 basis point hike from 4% at an out-of-cycle meeting in May 2022, the first increase in almost four years, so “it is now necessary to assess the cumulative effect of the hikes”. Early signs of a slowdown in bank credit growth are evident, slowing to 15.7% y/y by 10 March 2023, down from a decade high of 17.9% in October 2022.

Since the RBI has already raised interest rates by 250 basis points since May 2022, it has refrained from any such rate hikes even if inflation continues to breach the 6% tolerance level.

pause instead of spin

The decision will provide relief to borrowers in rate-sensitive sectors such as real estate, including residential complexes, passenger cars and commercial vehicles, whose home loans and other EMIs are unlikely to rise. In addition, large debt companies, growth stocks, small and mid-cap space companies, and specific industries (i.e., consumer durables and real estate) are not adversely affected. Business sentiment will improve by keeping a rise in borrowing costs in check, boding well for the broad-based Indian economy. Even if domestic demand dynamics remain healthy, any further hike in the benchmark repo rate at this point will weigh on India’s economic growth.

However, wholesale borrowing costs in the money market are likely to rise due to the RBI’s decision to reduce excess liquidity. Incidentally, this status quo decision by the RBI is in line with that of some other central banks in the region, including Indonesia, South Korea, and Malaysia.

further hike

The Monetary Policy Committee (MPC) remains focused on unwinding accommodation to ensure that inflation is gradually brought in line with the target while supporting growth. The RBI governor did not give a clear indication of a rate hike after the next MPC meeting. But reading between the lines, the policy statement strongly hinted that another rate hike might be on the way, as “the war on inflation continues until we see a sustained decline in inflation approaching target”.

The Governor said, “The Monetary Policy Committee has unanimously decided to keep interest rates unchanged at this meeting and is prepared to act if circumstances so require. The MPC will not hesitate to act as required in future meetings”. While keeping rates unchanged, the Governor emphasized that core inflation remains sticky. As a result, the repo rate may reach 6.75% and may end up with a 25bps rate hike in 1H FY24.

Inflation, GDP

High retail inflation since December 2022, a spike in food inflation, and persistently high core inflation for many goods and services have caused concern and panic. While headline inflation (total inflation in an economy, including prices of food, fuel and other commodities) is likely to moderate in FY24, the trajectory of inflation will depend on domestic and global factors, namely global dynamics, record rabi food Production, crude oil price fluctuations and potential high imported inflation risk and El Niño phenomenon.

India’s real GDP is likely to grow by 7% in 2022-23, with economic activity remaining resilient to global spillovers. RBI is closely monitoring banking turmoil in some countries and rupee volatility. The Reserve Bank of India slightly raised its economic growth forecast for the current fiscal year to 6.5% from 6.4%. The traction of high-frequency indicators such as fuel consumption, car sales, PMI manufacturing and services, and GST collections is reflected in higher annualized growth rates and sequential improvements. FY24 GDP growth is expected to be 6.5% despite protracted geopolitical tensions, tightening global financial conditions and turmoil in global financial markets. The current account deficit narrowed sharply to 2.2% in the third quarter from 3.7% in the second quarter; foreign exchange reserves surged to over US$600 billion, and fiscal consolidation bodes well.

rupee depreciation

Rupee depreciation in 2022 and 2023 is smaller (in line with the decline of most major currencies, the rupee depreciated by 7.8% in FY23, while the depreciation was more pronounced in Chinese yuan, Korean won, Malaysian ringgit and Philippine peso) reflecting the The strength of domestic macroeconomic fundamentals and the resilience of the Indian economy to global spillovers from recent developments in US and European financial markets.

These uncertainties, combined with rising inflation, have contributed to financial market volatility, reflected in sharp two-way swings in bond yields, falling stock markets and the U.S. dollar no longer being the global default currency. While these spillovers jeopardize short-term investment flows to emerging markets, including India, Indian banks are well capitalized.

other measures

An important development measure involves the development of an onshore non-deliverable derivatives market. The regulatory measures sought to improve the efficiency of the supervisory process, develop a centralized portal for the public to inquire about unclaimed deposits, and establish a grievance mechanism related to credit information reported by credit agencies and credit information provided by credit reference companies.

In terms of payment and settlement system, welcome to operate the pre-approved credit line at the bank through the UnionPay interface. All these measures with an important background will increase the strength and dependence of India’s financial sector.

All in all, given the trade-off between growth and inflation, RBI Governor Shaktikanta Das made the right decision by recalibrating monetary policy and effectively passing it through to financial markets, especially at a time when the global synchronized slowdown to less than 3% this year In context, India and China account for half of global growth in 2023.

author